Where Did The Rupees Go?

Hello again dear ones,

Knight Sky and I hope you are well and that your curious minds are still asking questions. We have decided that we will enlighten you on the Colombo stock exchange today and then move onto the big question of where did the rupees go? The Colombo stock exchange is the main stock exchange in Sri Lanka that utilizes an electronic trading platform.

The CSE headquarters have been located at the World Trade Center in Colombo since 1995 and it has regional branches in Kandy, Jaffna, Kurunegala and other locations. Take a look at this chart that Knight Sky put up before I move on.

| Turnover Rs. Billion | Market Capitalization Rs. Billion | All Share Price Index (ASPI) | ||

| 2015 | 253.251 | 2,938.00 | 6,894.50 | |

| 2016 | 176.935 | 2,745.40 | 6,228.26 | |

| 2017 | 220.591 | 2,899.30 | 6,369.26 | |

| 2018 | 200.068 | 2,839.50 | 6,052.37 | |

| 2019 | 171.099 | 2,851.30 | 6,129.21 | |

| 2020 | 396.856 | 2,960.70 | 6,773.22 | |

| 2021 | August | 8,134.52 | ||

| November | 10,132.12 | |||

| 2022 | January | 13,371.61 | ||

| March | 3,826.50 | 10,284.30 | ||

| April | 8,134.77 |

Source: Annual Reports 2016-2020, Colombo Stock Exchange: www.cse.lk

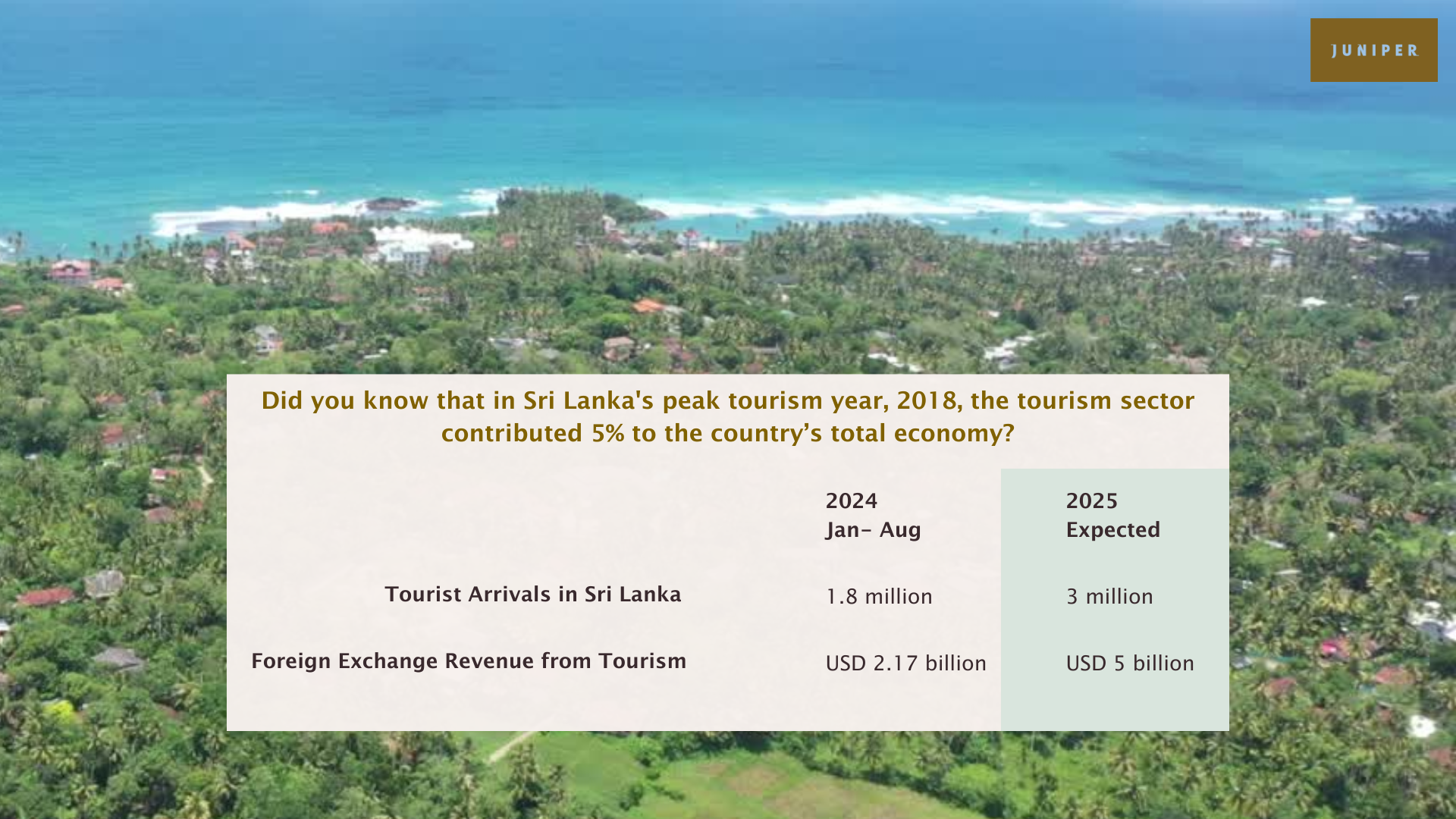

So where did the rupees go? In short, investments. On average, I have found out that Sri Lankans spent approximately 1 Billion USD annually on foreign travel.

During 2019-2021, these funds were “unutilised’. And of course the result of the modern monetary theory- printed rupees were also a large contributor. But! The efficient private sector also made sizable profits after taxes.

The Colombo Stock Exchange witnessed unprecedented growth from 2020, ASPI moving from 6700+ points to a whopping 13,370+ by January 2022. Market Capitalisation by March 2022 was a little over USD 3.8 billion. All this came to an unfortunate hold in February 2022, resulting in continuous market closures.

What was the star investment then? Some investors chose one of the oldest, safest, most reliable, but long-term form of investment- Real Estate.

That’s right! Real estate across the board witnessed a massive growth. And thanks to our very conservative banking system, this did not cause a real estate bubble, because the banks did not give unusually high valuations for these developments; whether it was land or apartments, the real estate market grew organically.

Though individuals and businesses were heavily investing in real estate; Bare lands, homes, apartments, and commercial properties, bank valuations on property were calculated conservatively. Also banks were only providing 60% of their forced sale value for

borrowers. In short, the subprime lending recession that happened in the USA in 2008-2009 did not happen in Sri Lanka during these challenging times, thanks to our conservative banking system.

And that is my answer to you, dear seekers! Do come back to me with all your questions. Knight Sky and I enjoy the research and analysis!

Yours Truly,

Jupiter Sebastian.