Real Estate Simplified

Hello to all my curious friends!

I have received a lot of requests from you to share with you what I know about real estate. So this is what I will get into in this letter today. Knight Sky gives you his regards and has advised me to explain things in the simplest way possible and that is what I will do.

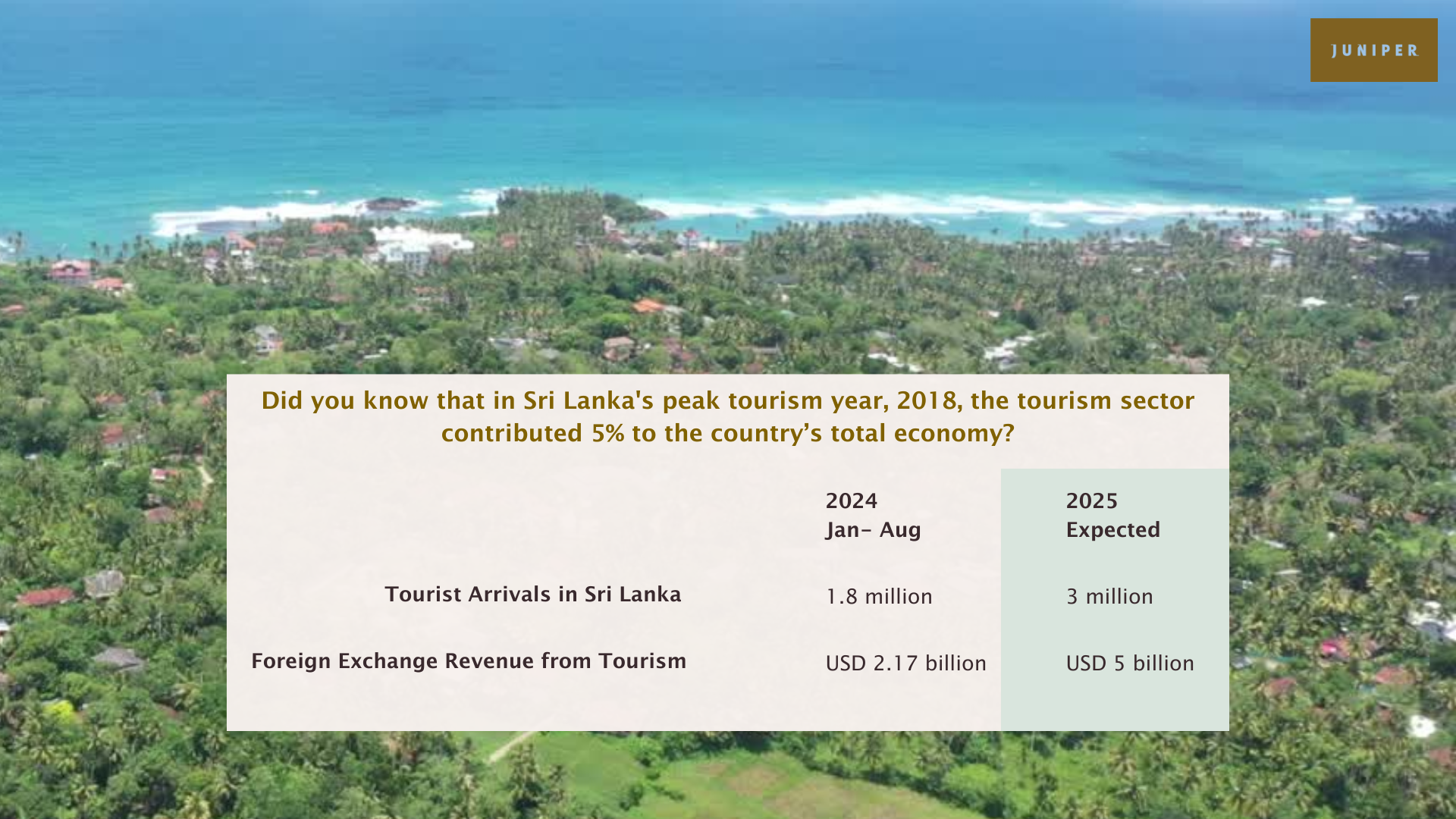

In the present Sri Lankan economic environment investing in real estate is the best option for any investor. The real estate investor when undertaking his or her decision to invest should seek proper advice from an expert in the field of real estate to identify the best option available. This is because, dear readers, investing in real estate as a whole will not generate the rate of return one is seeking. For instance, buying land is investing in real estate, however, where you buy the land is a critical factor. This is where individual investors make a serious mistake. Therefore, real estate investing is a science of its own. One should not underestimate the science behind the advice provided. Things are simple to understand so far, right? Knight Sky says yes.

The real estate market consists of a substantial mix of investment options. For example, rental income based commercial properties, single family homes, real estate investment trusts, real estate crowdfunding platforms, and the list continues to expand. Our research at Jupiter Lands, within the Sri Lankan real estate market has shown that physical property or purchasing developed land is the most suitable investment option. Some argue that this does not generate any forms of passive income. Although, the answer to that is ‘Yes’, the return on the passive income yield will generate negative returns. This in turn will bring down the strength of one’s investment portfolio. Furthermore, purchasing land will enable one to work closely with their taxable income.

Today, there are key real estate pockets where the property prices are still undervalued where one has the opportunity to enter and enhance their real estate values. These strategic investments will hedge against the rate of inflation, and further provide real estate benefits. In light of the above it is imperative that potential investors explore these opportunities via highly research based real estate companies and real estate developers who possess in-depth information on markets.

So, what do you think? Hopefully this answers some of your questions and helps you understand why you should trust research-based real estate companies. Stay connected for more!

Yours Truly,

Jupiter Sebastian.